In this post, we have reviewed some of the 5 best money-saving apps that you can use in 2023 to boost your savings and reach your financial dreams. We have compared their pros and cons, and given you some real examples on how to use them.

Download 5 best Money-Saving Apps You Need in 2023

Wanna get rich quick? Download 5 best money-saving apps

- How money-saving apps can help?

- Top 5 Money-Saving Apps

- Comparison of Money-Saving Apps

- Where to Download Money-Saving Apps?

- Are they free?

- How Much Can You Save with Each App?

- How Much Can You Save? What Do with the Money?

- Final Thought

1. How money-saving apps can help?

1 How money-saving apps can help? Saving money is an important part of financial planning. However, it can be difficult to know where to start. Fortunately, there are many money-saving apps available that can help you save money and reach your financial goals. In this article, we’ll take a look at the top 5 money-saving apps for 2023 and how they can help you save money.

2. Top 5 best Money-Saving Apps:

- Acorns

- Qapital

- Starling

- Forbes Advisor

- Truebill

1. Acorns: If you want to start investing but don’t have a lot of money or knowledge, Acorns is the app for you. Acorns rounds up your purchases on linked credit and debit cards and invests that spare change into a diversified portfolio of exchange-traded funds (ETFs). You can also set recurring deposits and earn cash back from partner brands. Acorns is ideal for beginners who want to grow their money without much effort or risk.

2. Qapital: If you need some motivation and creativity to save money, Qapital is the app for you. Qapital lets you set up rules that trigger savings, such as rounding up your purchases, saving a percentage of your income, or rewarding yourself for good behavior. You can also create savings goals and track your progress. Qapital is ideal for savers who want to have fun and customize their savings experience.

3. Starling: If you want a digital bank that offers a range of features to help you save money, Starling is the app for you. Starling is a mobile-only bank that provides spending insights, budgeting tools, savings pots, and interest on your balance. You can also earn cash back from partner merchants and access overdrafts and loans. Starling is ideal for savers who want a simple and convenient banking app that helps them manage their money better.

4. Forbes Advisor: If you want a financial education platform that provides expert advice, reviews, and tools to help you make smarter money decisions, Forbes Advisor is the app for you. Forbes Advisor is a website and app that helps you compare products and services across banking, investing, insurance, credit cards, and more. You can also access calculators, quizzes, and guides to improve your financial literacy. Forbes Advisor is ideal for savers who want to learn more about money and find the best deals for their needs.

5. Truebill: If you want to track your bills and subscriptions and lower your expenses, Truebill is the app for you. Truebill is an app that helps you manage your recurring payments and negotiate lower rates for your cable, internet, phone, and other services. You can also cancel unwanted subscriptions, get refunds for bank fees and outages, and set up savings goals. Truebill is ideal for savers who want to reduce their monthly bills and avoid unnecessary charges.

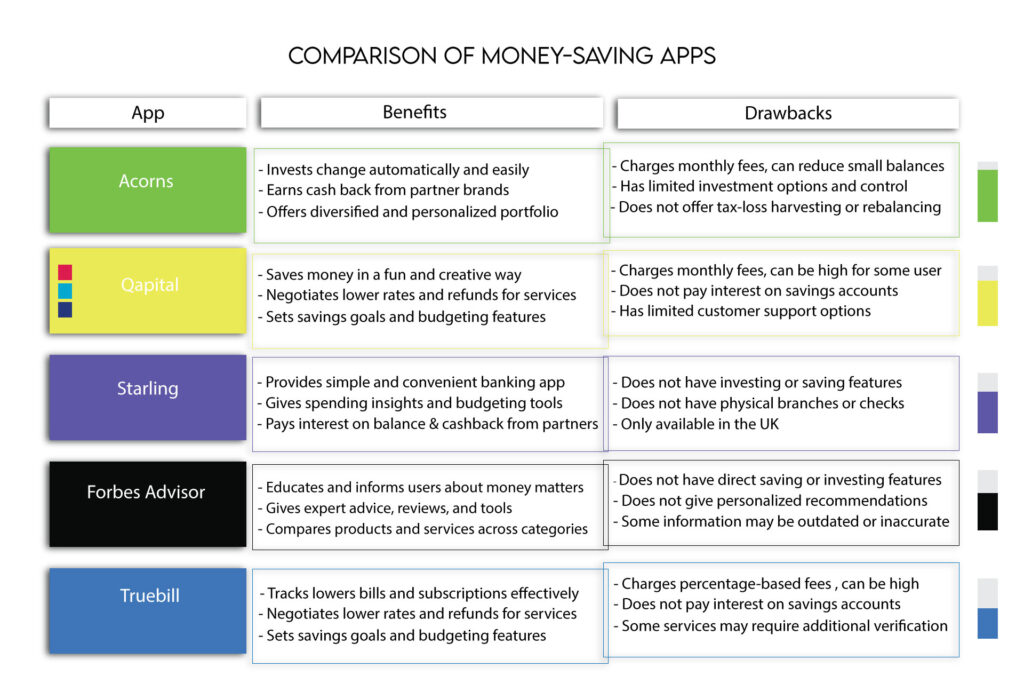

3. Comparison of 5 best Money-Saving Apps

4. Where to Download 5 best Money-Saving Apps?

All of these apps are free to download on the App Store or Google Play Store. Simply search for the app name and click “Download” to get started

Read more: How I saved 1000 $ dollars every month?

5. Are they free?

- Acorns charges $1-$5 per month which depends up on the plan you select, which includes features like retirement accounts, checking accounts, and debit cards

- Qapital charges $3-$12 per month depending on the plan you choose, it includes features such investing, budgeting, and banking

- Starling is free to use and has no monthly fees or foreign transaction fees

- Forbes Advisor is free to use and has no hidden fees or commissions

- Truebill charges ranges from 30% to 50% a percentage of the savings they get for you

6. How Much Can You Save? What to Do with the Money?

1. Pay off debt

For example, if you have a credit card balance of $5,000 with an interest rate of 18%, and you only make the minimum payment of $100 per month, it will take you 94 months (almost 8 years) to pay it off and cost you $4,311 in interest. But if you use your savings of $1,000 to pay off part of the balance, and then pay $150 per month, it will take you only 32 months (less than 3 years) to pay it off and cost you $1,055 in interest. You will save $3,256 in interest and 62 months of payments.

2. Build an emergency fund

Let’s say you have a monthly income of $3,000 and monthly expenses of $2,500, you should aim to have an emergency fund of at least $7,500 (three months of expenses). If you use your savings of $1,000 to start your emergency fund, and then save $250 per month, it will take you 26 months (a little over 2 years) to reach your goal. Having an emergency fund will give you peace of mind and security in case of a financial crisis.

3. Invest for the future

We will assume that you have a retirement goal of $1 million by age 65, and you start investing at age 25 with your savings of $1,000, and then contribute $300 per month with an average annual return of 8%, you will reach your goal by age 60. You will have a total of $1,036,226 by then. If you start investing at age 35 with the same amount and return, you will only have $379,065 by age 65. You will miss out on $657,161 due to the power of compound interest

4. Treat yourself

If you have saved up $5,000 after achieving your financial goals and have some money left over, you can use it to treat yourself. You can book a flight to Hawaii for $800, stay at a beach resort for $1,200, enjoy some activities and food for $1,000, and still have $2,000 left. You can use that money to buy a new laptop for $1,000, and donate the remaining $1,000 to a local animal shelter. You will have a memorable and rewarding experience with your money

Saving money is not only a smart financial move, but also a rewarding and satisfying one. When you save money, you are not only preparing for the future, but also enjoying the present. You can use the money you save to pay off debt, build an emergency fund, invest for the future, or treat yourself. You can also use it to support a cause that you care about, or share it with your loved ones.

7. Final Thought

In the first place saving money can also be challenging, especially when you have multiple financial goals and expenses. That’s why using some of the 5 best money-saving apps can make a huge difference. These apps can help you save money more easily and more fun. They can also help you manage your money better and make smarter financial decisions.

In conclusion, productivity is not just about working harder or being busy all the time. It’s about making the most of your time and energy to achieve your financial goals and live a fulfilling life. By adopting the right mindset, setting clear priorities, and developing saving habits and strategies, you can unlock your full potential and achieve great things. Remember to take breaks, stay organized, and stay motivated. With patience and consistency, you can become a rich and successful person. Good luck!